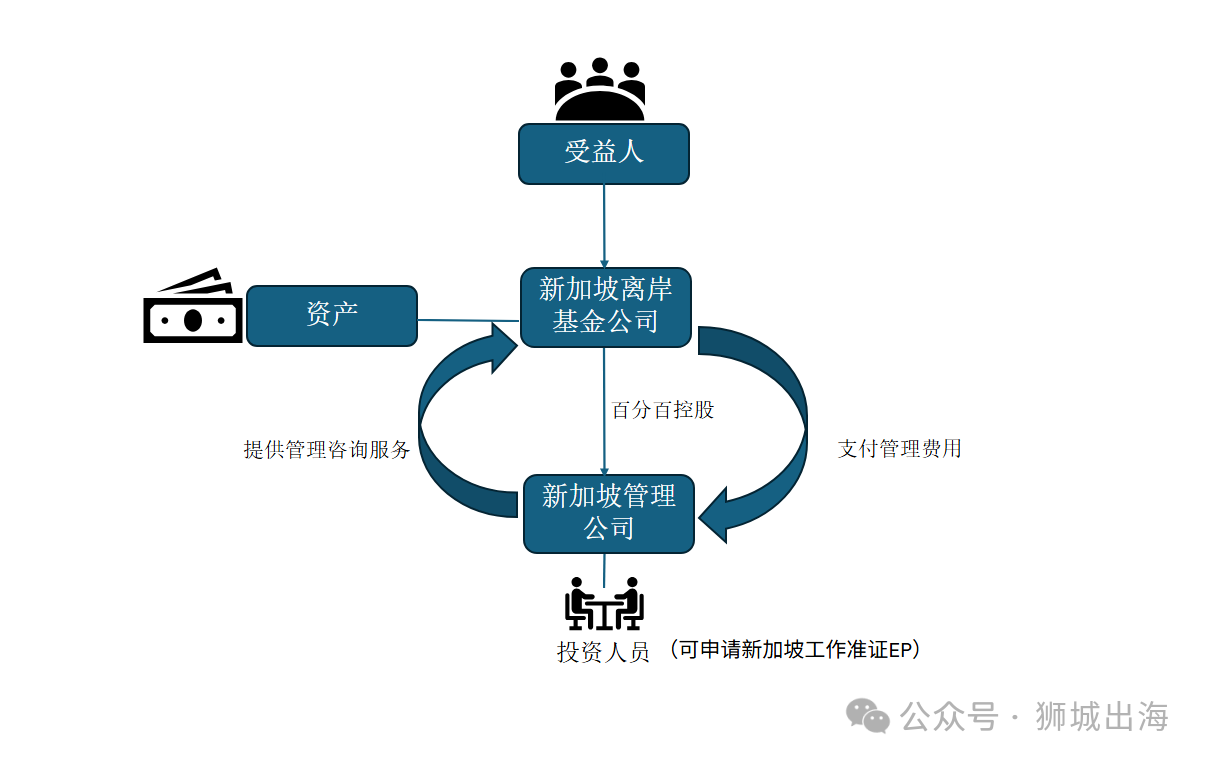

✔ Must be managed by a Singaporean entity

The fund house needs to be managed by a Singaporean fund management company (SG FMC) for investment management.

✔ Investment Professional (IP) requirements

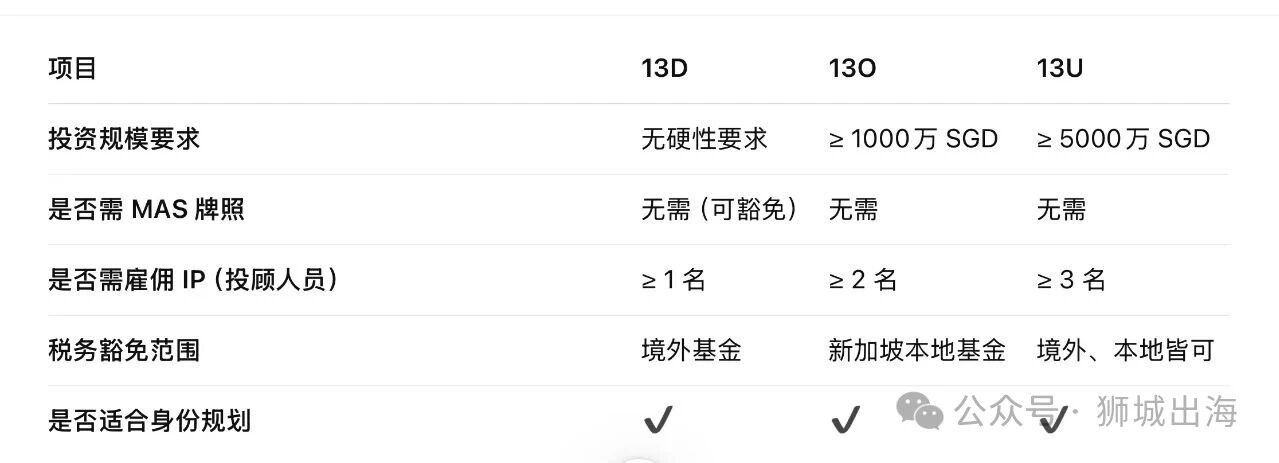

- At least 1 IP

- No minimum salary requirement

- May be a family member (subject to reasonable investment experience)

✔ No MAS license required

Adoption of a legal opinion (Legal Opinion) is exempt from CMS licensure.

2) Fund Management Company (FMC)

- Registered in Singapore

- Investment management services to fund companies

- Possibility of applying for EP, identity planning

- Exempt from CMS Capital Markets Services License

The two form a compliance structure through the Investment Management Agreement + Legal Opinion.

- Key investment decisions are not made in Singapore

- No local office/team

If physically operating in Singapore, you may be considered as a Singapore tax resident → 17% corporate income tax is payable.

② Fund Management Company (Singapore Registered)

Must be recognized as a Singapore tax resident company, need:

- Bookkeeping, tax returns, audits (if applicable)

- Satisfy general corporate operating compliance requirements

③ Individual tax resident (EP holder)

A person is tax resident in Singapore if he or she satisfies any of the following criteria

- Residence ≥183 days per year

- Working in Singapore and receiving a salary (e.g. EP)

- Primary income from Singaporean companies

Individuals file income tax returns at the Singapore tax rate (0-24%).

⚠ If still a tax resident of China → need to be aware of global tax rules (avoid double filing)

- Families with assets ranging from $5 million to hundreds of millions of dollars

Features:

Low financial threshold

Flexible Architecture

High tax compliance

Can take into account identity planning

✔ The architecture is easy to build

✔ Maximum investment flexibility

✔ Strong tax incentives

✔ Ability to apply for EP for family members

✔ Ideal for high net worth families with large offshore assets The 13D Family Office in 2025 remains one of the most cost-effective and flexible global asset planning tools.

Establishment and management of family offices

Singapore Immigration Planning (with Self-Employment EP)

Total Wealth Management and Inheritance

Feel free to contact us for your exclusive globalization solution.]